Image: Oxfam International

By: Nick Russo TheAnimatingContest.com January 21, 2016

THEY ARE COMING FOR IT ALL!!

The answer to the economic crisis of 2008 was to have the central banks of the world engage in an unprecedented coordinated plan of global monetary stimulus. Monetary stimulus means printing money-literally out of thin air and backed by nothing but the faith and tax payments of the citizens. This is what is referred to in the United States as Quantitative Easing and, so far, we have had three rounds of it. The master planners of the world’s largest economies are now acting Globally. Global actions were sold to the citizens of the large economies during the duress of the Crisis. The Crisis was so big “it could only be solved in a Global manner”. After all, we have been told over the last several decades that Globalism was the answer to all the world’s problems.

Well, let’s take a look a how the Globalist’s economic solution of monetary stimulus (money printing) has “solved our economic problems”. So as to not get into a long technical discussion of economics; we must assume the basic law of economics which is when monetary stimulus (money printing) takes place it has the effect of immediately lowering interest rates.

For almost a decade now, the central banks around the world have been artificially suppressing interest rates by printing money. According to the Globalists, this suppressing of the interest rates was supposed to stimulate borrowing, stimulate spending, create jobs, and boost real wages and the economy. This is what has happened in reality:

Let’s take a common working person example: If, for the last eight years you have been working hard and saving your money, you have been robbed by the global central banks. Let’s say you had $150, 000 saved entering the years 2008-2015 and saved another $80,000 during this same eight year period. You believed in the American Dream and you really have been working hard and doing the right thing–saving money for your family’s future. In the years just before 2008, interest rates averaged around 4.5%. I personally had a CD during this time period which paid me 5% on my deposit. Since 2008, and including today, the interest rate in the United States has been artificially held down to virtually 0%, with the central bank recently raising rates for the first time in eight years to 0.25%. You probably have noticed over the last eight years that your bank accounts basically pay NO interest and, therefore, your money has earned nothing.

Let’s run some numbers using a conservative, pre-2008, 4% average annual simple interest rate:

Non-manipulated Interest Rates Scenario (Normal):

Beginning Balance entering 2008 –$150,000

Money Saved During 2008-2015 — $ 80,000

($150,000) beginning balance: Interest Earned — (150,000 x 4% annual interest) times eight years = $6000 x 8 = $48,000

($80,000) Avg. Interest Earned on accrued savings — ( $10,000 avg yearly savings x 4%) = ($400 annual interest) time 8 years = $3,200

Total Interest Accrued: $51,200

Actual Artificially Suppressed Interest Rate Scenario (0.05% Rate):

Beginning Balance entering 2008 –$150,000

Money Saved During 2008-2015 — $ 80,000

($150,000) beginning balance: Interest Earned — (150,000 x 0.05% annual interest) times eight years = $75 x 8 = $600

($80,000) Accrued Savings Avg. Interest Earned — ( $10,000 avg yearly savings x 0.05%) x 8 yrs = ($5 annual interest) times 8 years = $40

Total Interest Accrued = $640

As you can see, this individual in the above example has been artificially denied (robbed) of $50,560 due to global central banks manipulating interest rates to zero by printing money. This is real money which could have been used to raise a family, put a child through school, buy a house, etc.

But where did this money go?

When Global Banks, Hedge Funds, and large Private Equity Firms have access to large credit lines at extremely low interest rates they are given the ability to make literally Hundreds of Billions of dollars. By borrowing at close to zero interest rates and investing in assets (i.e. stock markets) which are artificially boosted by zero interest rate policies you make billions of dollars and your return on investment becomes close to Infinite.

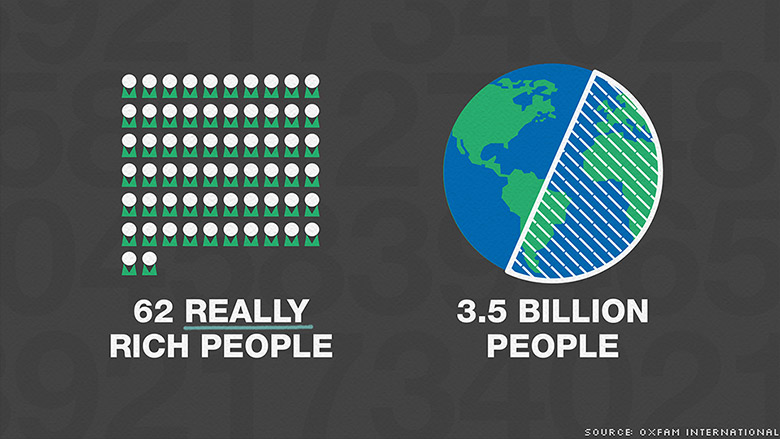

A recent article from CNN reveals what has happened to all the money which Savers have been robbed of due to manipulated interest rates–see source here. Excerpts below-red comments added:

The study draws from the Forbes annual list of billionaires and Credit Suisse’s Global Wealth Databook.

The world’s 62 richest billionaires have as much wealth as the bottom half of the world’s population. (That’s 62 individuals with more wealth than 3.6 Billion people)

The wealthiest have seen their net worth soar over the five years ending in 2015. Back in 2010, it took 388 mega-rich people to own as much as half the world. (Dramatic Wealth Consolidation toward the top)

And the Top 1% own more than everyone else combined. (Top 1% have more wealth than 7.3 Billion people)

The top 62 saw their net worth rise by more than half a trillion dollars between 2010 and 2015, while the 3.6 billion people in the bottom half of the heap lost a trillion dollars. (Wealth Transfer from bottom half of people to top 62 individuals)

Wealth is moving rapidly to concentrate at the tippy, tippy top of the pyramid.

The poorest 20% of the world….barely saw their incomes budge between 1988 and 2011, while the most prosperous 10% enjoyed a 46% jump. (The average person’s wages have barely increased in real terms while the wealthiest incomes have skyrocketed)

As demonstrated, artificially low interest rates have robbed Savers of deserved income and have acted to transfer these losses to the wealthiest individual asset owners on the planet.

WE have been robbed in broad daylight and no one evens recognizes it!

In the last crisis of 2008–it came down to who is going to bear the losses–the working people or the large corporations and banks–the answer, as it always has been, was the working people.

We are now seeing the measurable effects of Global Economic Policies made by the global elite and which benefit only the elite. These Economic Policies are literally funneling all national wealth upward into the elite’s coffers–wealth that literally comes from working peoples’ pockets as demonstrated above–we have been financially raped.

Wealth disparity like what we are currently experiencing always leads to extreme discontent and societal instability. These type of Crises are the intended consequences of the policies (Crisis-Reaction-Solution). The Globalists are trying to breakdown existing societies and rebuild them into their control-based authoritarian model called Globalism–the tactic is to financially break the majority of people, so the free people of the world will beg for their help–which they will gladly give, but which comes with loss of Individual Liberty as its ultimate cost. You will be taken care of, but nothing is free! This is modern warfare. This is how societies are taken over today!

The Globalists create the Crisis (financial in this example). Then, they will falsely blame Free Market Capitalism for the abuses. Capitalism is not broken–Crony Capitalism Is Breaking US! If the Globalists were truly free market thinkers they would let the FREE MARKET dictate the PRICE of MONEY (a.k.a-the Interest Rate). But they do not –the Globalists artificially set the price of money to the interest rate that benefits the elite only, at the expense of us ALL. It is Interest Rate Apartheid. We pay for their losses through tax payer bail outs–and we are expected to just get by.

HOW MUCH STEALING FROM YOUR POCKETS WILL YOU TOLERATE?

IT IS TIME FOR INDIVIDUALS TO START GOING TO JAIL!

LET THE RULE OF LAW BE EXERCISED NOW-SO THAT THE RULE OF FORCE DOES NOT HAVE TO BE EXERCISED IN THE FUTURE.

Hi to every one, the contents present at this web site are really amazing for people experience, well, keep up the nice work fellows.

Its such as you read my mind! You appear to know so much approximately this, such as you

wrote the guide in it or something. I believe that you could do with some % to power the message home a

bit, however other than that, this is great blog.

A great read. I’ll certainly be back.

signed up for emails