By: Nick Russo TheAnimatingContest.com March 25, 2015

After trying to fight the creation of a China based global lending institution for a year, the United States is “forced” to join the institution which was created as a competitor of the United States’ controlled World Bank. The U.S. decision to join the China dominated global bank came after a whole host of its western allies joined the institution as an alternative financing source to the World Bank.

“In what one analyst dubbed a “diplomatic disaster” for the U.S., Britain became the first major European ally to sign on as a founding member of the Shanghai-based investment bank, joined quickly by France, Germany and Italy, which dismissed public and private warnings from the U.S. about the bank’s potential impact on global lending standards and the competition it could provide to existing institutions such as the U.S.-dominated World Bank.”

“Instead of fighting the new China-led development bank, the US was forced to add its support to the development bank after allies jumped ship to join the $100 billion China-led project that could rival the World Bank.”

Since 1944, The World Bank has been a powerful tool for the United States. In order to receive World Bank loans, countries have to adhere to strict conditions which fit into the overall global strategic objectives of the United States. For instance, the very first loan given by the World Bank was to France and included strong conditions:

“…before the loan was approved, the United States State Department told the French government that its members associated with the Communist Party would first have to be removed. The French government complied with this diktat and removed the Communist coalition government. Within hours, the loan to France was approved.”

In addition to adhering to strict political conditions, The World Bank also imposes draconian economic policies that the debtor country must adhere to. These strict economic policies are called structural adjustment policies and are used to “streamline” the economies of the debtor nations. These structural adjustment policies cause major structural realignments within the country. The structural adjustment policies overwhelmingly effect the working and poorer classes by forcing the debtor nation into austerity programs which lead to lowering of wages and to reducing health care, education, and other social programs designed to aid these economic classes:

“UNICEF reported in the late 1980s that the structural adjustment programs of the World Bank had been responsible for “reduced health, nutritional and educational levels for tens of millions of children in Asia, Latin America, and Africa”

Critics of The World Bank site these strict policies as being heavy handed and essentially taking the debtor nations sovereignty away. If a nation is forced to throw people out of their government and increase the poverty level of their population, then that nation’s sovereignty has been effectively nullified. These policies demonstrate how debt is used as as weapon of dominance to subjugate nations.

Over the last sixty years, nations and their citizens grew tired of these dictatorial policies and a competitor arose out of this dissatisfaction. During these last six decades of World Bank and United States dominance, China’s economy has been growing and eventually caught up with the United States. See Fox News Below:

“The IMF recently released the latest numbers for the world economy, stating that China will produce $17.6 trillion in terms of goods and services– compared with $17.4 trillion for the U.S.”

Now China, the other global superpower, has created a global lending bank itself to challenge the supremacy of the (US) dollar dominated World Bank and its abuses.

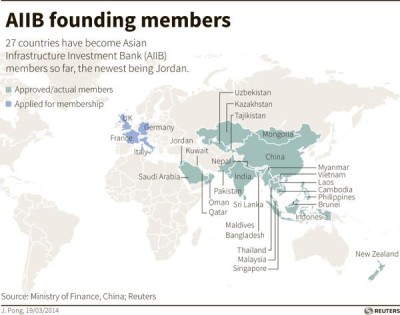

The Asian Infrastructure Investment Bank, as it is known, was first introduced conceptually in October 2013 and was officially formed in October 2014. In only six months since its launch, the Chinese dominated global lending institution has attracted major nations from around the world to join. These member nations include some of the United States’ major western allies demonstrating a growing distrust of the US Dollar dominated global financial system.

“The British government was the first to announce that they would be a founding member of the financial institution, which is largely seen as a rival to the World Bank. Luxembourg and Switzerland were the latest to sign up along with France, Germany, and Italy. “

The distrust of the U.S. dominated global financial system stems from the system’s abuse which includes politically strong arming sovereign nations such as Iran, Russia, and others by revoking their use of the SWIFT bank clearing systems. The revoking of SWIFT participation effectively isolates sovereign nations from the international banking system and cripples their economies. All nations now worry that if they criticize or do not go along with the United States’ global strategic objectives, their economies could be devastated by their isolation from the international financial system.

The United States has been mixing politics and economics for a long time through the use of debt as a weapon. We have been bullying and forcing compliance on political issues in order for countries to gain access to credit which is the life-blood of all modern economies-and the world is sick of it. Our abuse of the dollar as the international reserve currency has led to competitors arising and to the reduction of American influence globally.

What we must be aware of and guard against is the intentional integration of the failing World Bank system INTO the new China based system. This scenario would effectively amount to a deal cut between the United States and China to dominate global finance together or “meet the new boss-same as the old boss”.

Will we be fooled again?

Real competition in international finance is necessary to a real global balance of power and an end to financial tyranny.

What i don’t realize is in truth how you are not really a lot more well-appreciated than you might

be now. You are so intelligent. You already know

therefore considerably in the case of this matter, produced me in my

view believe it from so many varied angles. Its like men and women are not involved until it’s one thing

to accomplish with Lady gaga! Your own stuffs great. Always

maintain it up!